Capital Gains Account Scheme (CGAS) : A Detailed Guide

When selling assets like property or stocks, the profit earned constitutes what is known as a capital gain, which is taxable under the Indian Income Tax Act, 1961.

However, to promote investment in certain assets and help taxpayers manage their capital gains efficiently, the Government of India introduced the Capital Gains Account Scheme in 1988.

This article provides an essential guide to understanding and utilizing the Capital Gains Account Scheme (CGAS) to plan your taxes effectively and ensure compliance while optimizing tax liabilities.

Purpose of CGAS

The primary purpose of CGAS is to facilitate taxpayers in deferring their tax liability by reinvesting their capital gains.

Under various sections of the Income Tax Act, such as Section 54, 54B, 54D, 54F, and 54G, taxpayers can claim exemption from capital gains tax if the amount is reinvested under specified conditions.

However, if the gains are not immediately reinvested, CGAS allows the depositor to deposit these gains into specified accounts temporarily, thereby still availing the tax exemptions.

Who Benefits from CGAS?

CGAS is beneficial for any taxpayer who has earned capital gains from the sale of an asset and who intends to claim an exemption under sections 54, 54B, 54D, 54F, or 54G by reinvesting the proceeds but needs more time to plan or finalize the investment.

It ensures compliance while providing flexibility in financial planning. This scheme is particularly advantageous for those who sell their assets towards the end of the financial year and may not have enough time to reinvest their gains to claim tax exemptions within the same fiscal year.

Overview of CGAS

Defining Capital Gains

Capital gains are profits that a taxpayer earns from the sale of capital assets like property, shares, or bonds. The gains are classified as long-term or short-term based on the holding period of the asset, which affects the tax treatment. Understanding these basics is crucial in planning your taxes around the capital gains effectively.

Key Provisions Related to CGAS in the Income Tax Act

Under the Income Tax Act, the provisions that allow for tax exemptions on capital gains (subject to certain conditions and reinvestment criteria) are sections 54, 54B, 54D, 54F, and 54G.

For detailed guidance on these sections, professionals can consider looking into services like income tax return filing, which can significantly assist in navigating through these tax exemptions.

Each section caters to different scenarios and assets, which can sometimes get complex without careful interpretation and understanding.

Applicability of CGAS

CGAS is applicable to all assesses eligible for exemptions under the referred sections. Whether you are planning to invest in another residential property after selling one, as elaborated under Section 54, or looking into other assets, ensuring that your capital gains are temporarily held in a CGAS account can be a prudent step to manage unforeseen delays in your investment plans and still adhere to the compliance requirements.

This guide will next delve into the types of accounts under CGAS, detailing their features, how to set them up, manage, and ensure compliance through appropriate tax litigation services, and withdrawal mechanisms in the subsequent sections.

For those needing a seamless processing of their tax filings, understanding CGAS’s implications on faceless assessments can also be exceedingly beneficial.

Types of Accounts under CGAS

When approaching the Capital Gains Accounts Scheme, understanding the types of accounts available is crucial. CGAS offers two types of accounts – Account-A and Account-B, each catering to different needs and offering unique features.

Account-A: Savings Deposit

Account-A operates similarly to a savings account, where flexibility is key:

Features:

- You can deposit and withdraw funds at will, subject to the scheme’s restrictions.

- Interest is computed and paid similar to regular savings accounts, maximizing accessibility.

Advantages:

- Immediate access to funds for when quick reinvestment opportunities arise.

- Less restrictive, providing ease of money management.

Account-B: Term Deposit

For those looking for a more stable investment with potentially higher returns, Account-B is structured as a term deposit:

Features:

- Funds in Account-B are locked in for a period that you choose at the time of deposit.

- You can opt for cumulative deposits, where interest gets reinvested, or non-cumulative deposits, where interest is paid out at regular intervals.

Advantages:

- Typically offers higher interest rates compared to savings accounts.

- Suitable for investors who do not need immediate access to their funds and are looking towards long-term gains.

Decision Guidelines: Choosing Between Account-A and Account-B

Choosing the right account type under CGAS depends largely on your financial goals, investment timeline, and need for liquidity. Here’s a quick guide to help you decide:

Choose Account-A if:

- You expect to reinvest your capital gains shortly.

- You require flexibility and access to your funds.

Opt for Account-B if:

- You plan to reinvest but are waiting for the right opportunity over a longer term.

- You are aiming for higher interest accumulation through a term deposit.

Each type of account has its nuances, and choosing the right one can significantly impact your tax planning and investment returns.

How to Open and Operate CGAS Accounts

Navigating the process of opening and managing a Capital Gains Accounts Scheme (CGAS) account can seem daunting, but with the right information, it can be straightforward and beneficial for your financial planning. Here’s a step-by-step guide to getting started with CGAS accounts.

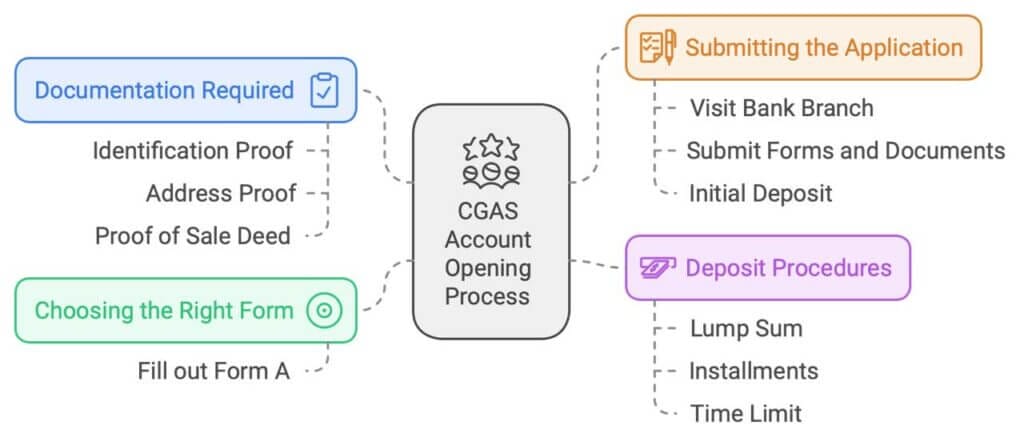

Step-by-Step Guide to Opening an Account

Documentation Required:

- Identification proof (Aadhar card, PAN card, etc.)

- Address proof (Utility bills, Passport, etc.)

- Proof of the sale deed/transaction that resulted in the capital gains.

Choosing the Right Form:

- You need to fill out ‘Form A’ for opening either type of account. Ensure all details are filled correctly to avoid future discrepancies.

Submitting the Application:

- Visit the nearest authorized bank branch that offers CGAS services.

- Submit the completed forms along with the necessary documents and the initial deposit amount.

Deposit Procedures

Lump Sum vs. Installments:

- You can choose to deposit the entire amount in one go or in installments, depending on your convenience and availability of funds.

- Remember, the deposit must be made within the specified time limit from the date of the capital gains transaction to benefit from the tax exemptions under CGAS.

Withdrawal Rules and Regulations

From Account-A:

- Withdrawals can be made at any time but need to be substantiated if they are intended for the purpose of investment to claim tax exemptions.

From Account-B:

- Withdrawals are generally restricted until the maturity of the term period. However, transferring funds from Account-B to Account-A can facilitate earlier withdrawals under certain conditions.

Case Study: Example of Withdrawal Process and Utilization

Scenario: Mr. Shah sold his property and had a capital gain of ?50 lakhs, which he deposited into CGAS Account-B. Two years later, he found a new investment property and needed the funds for a down payment.

Process:

- Mr. Shah applied for transferring his deposit from Account-B to Account-A using ‘Form B’.

- Once transferred to Account-A, he was able to withdraw the amount using ‘Form C’, citing the details of his new investment.

- This strategic transfer and withdrawal allowed Mr. Shah to use his funds efficiently while still enjoying the tax benefits under CGAS.

Opening and managing CGAS accounts require careful planning and adherence to the rules set forth by the scheme. By understanding the procedures and regulations, taxpayers can maximize their benefits and ensure compliance with tax laws.

The subsequent sections will delve into the interest calculations, practical applications for compliance, and account management, providing you with a holistic view of how to effectively use CGAS for your capital gains.

Interest Rates and Calculations

Understanding how interest is calculated on your Capital Gains Accounts Scheme (CGAS) deposits is crucial for financial planning and maximizing your returns. Here we’ll cover how interest rates are applied to both Account-A and Account-B.

Interest Provisions for Both Account Types

Account-A (Savings Deposit) Interest Rates:

- Interest is calculated on the minimum balance between the 10th and the last day of each month.

- The interest is credited to the account biannually, allowing the funds to compound, albeit at a lower rate compared to Account-B.

Account-B (Term Deposit) Interest Rates:

- Offers a higher interest rate due to the fixed nature of deposits.

- For cumulative deposits, the interest is reinvested and compounded annually or as per the term agreed upon, enhancing the investment value by the maturity date.

- For non-cumulative deposits, interest is generally paid out at regular intervals, providing a steady income stream.

Examples of Interest Calculations

For Account-A:

- Assume an initial deposit of Rs. 1,00,000 with no withdrawals for the month, and the interest rate stands at 3.5% per annum.

- Interest for the month = [(Rs. 1,00,000 * 3.5%) / 12 months] = Rs. 291.67 (rounded to nearest rupee).

For Account-B

- Assuming a deposit of Rs. 1,00,000 for a 1-year term with an annual interest rate of 5%.

- Interest for the year = [Rs. 1,00,000 * 5%] = Rs. 5,000.

- If it’s a cumulative deposit, this interest will be reinvested, thereby earning interest in the following years.

Understanding these interest rate applications will allow depositors to make informed decisions based on their financial needs and timelines.

Practical Applications and Compliance

Navigating the regulations around CGAS is not just about tax savings—it’s also about utilizing these funds in a manner compliant with the law to avoid any future complications.

How to Use Funds in Compliance with CGAS Requirements

Under CGAS, the withdrawn amounts must be utilized for the intended purpose within a specified period (typically, this must be done within 3 years for property investments). If the funds aren’t utilized within this period, the deposit must be closed, and the amount becomes taxable.

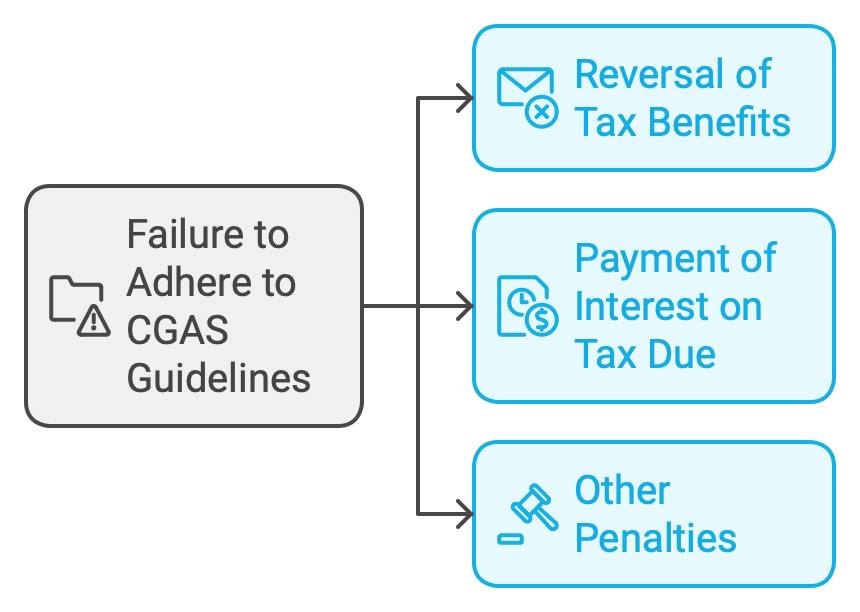

Penalties for Non-compliance

Failure to adhere to CGAS guidelines can lead to:

- Reversal of the tax benefits previously claimed under the exemption sections.

- Payment of interest on the tax amounts due.

- Other penalties as prescribed by the tax authorities.

Account Management

Effective management of your CGAS account is essential for ensuring that you maximize the benefits while adhering to the regulatory framework.

Transfer and Conversion between Accounts

Facilities are provided to transfer funds between Account-A and Account-B, which can be useful if your financial situations or goals change. Understanding the procedures for these transactions is crucial in maintaining liquidity and compliance.

Closure of Account

The closure of CGAS accounts should be timed to coincide with the completion of the investment for which the exemption was claimed. Proper forms and approval from tax authorities may be required to ensure that the closure is processed without any tax implications.

By comprehensively understanding, opening, and managing CGAS accounts, taxpayers can ensure they successfully use this scheme not only to save on taxes but to also enhance their financial planning.

The upcoming final sections will encapsulate a summary and offer last-minute tips on leveraging CGAS effectively.

Nomination and Legal Heirs

Setting Up Nominations

The CGAS allows depositors to nominate one or more persons (but not exceeding three) who can receive the amount standing to the credit in the event of the depositor’s death. This ensures that the funds are seamlessly transferred to the nominee without legal hassles.

Procedure for Nomination:

- Use

Form Efor initial nomination. - A nominatee can be changed or updated using

Form F. - All nominations must be registered at the deposit office where the account is held, which makes the nomination effective.

Considerations for Minors:

- If the nominee is a minor, the depositor should appoint a guardian to manage the funds until the minor reaches adulthood.

Legal Transfer Upon Death

In case of the depositor’s demise, the process for transferring CGAS account balances to a nominee or legal heir is straightforward, provided all documentation is complete.

- Process for Nominees:

- Application in

Form Hneeds to be submitted along with required documents like the death certificate of the depositor. - The deposit office then processes the closure of the account and transfers the funds to the nominee’s bank account.

- Process for Legal Heirs (in absence of Nomination):

- Legal heirs must provide a succession certificate or similar legal documents along with

Form H. - The amount is transferred after all legal clearances are given, ensuring that the funds are released to the rightful claimant.

Closure of the Account

Structured Closure Process

Closing a CGAS account requires careful consideration of the timing and the rationale, especially if it is linked to availing tax exemptions under the Income Tax Act.

- Voluntary Closure:

- Apply using

Form G. - Closure can only be approved by the Assessing Officer, ensuring that all tax-related conditions have been met.

- Mandatory Requirements:

- Along with the form, depositors need to submit the passbook or deposit receipt.

- Proper accounting and tax compliance checks are performed to ensure all dues are clear.

Distributing the Funds

Upon closure, the funds (including principal and accrued interest) are transferred directly to the depositor’s bank account, or in case of the depositor’s demise, to the nominee or legal heir’s account as directed.

Conclusion

The Capital Gains Account Scheme (CGAS), 1988, serves as a crucial tool for capital gains management, allowing taxpayers to defer and potentially reduce taxation while planning for future investments.

Utilizing CGAS not only aids in financial management but also ensures adherence to tax laws, preventing any legal issues related to mismanagement of capital gains.

By strategically managing Account-A and Account-B, understanding the stipulations for withdrawals, nomination, and legal transfers, and correctly timing the closure of accounts, taxpayers can optimize their financial outcomes while securing compliance with the regulatory framework.

This comprehensive guide aims to simplify the complex landscape of capital gains tax management, providing a roadmap for effective and efficient tax planning through CGAS.

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.